In an increasingly digitalised work environment, the risk of cyber-attacks has never been more prevalent. Given the complex nature of cyber loss, policies described as providing cyber insurance may not provide cover as broad as their names might suggest. Organisations should consider, with their insurance brokers or legal advisers, how their policy suites will respond to cyber risks and whether there are any material gaps in cover.

Many companies are experiencing ‘shock’ D&O premium increases that in some instances have been multiples of their previous year’s premiums. We have been working with a number of companies that have actively explored ways to manage or limit their D&O insurance expenditure.

A landmark decision has been handed down by the Supreme Court of England and Wales in The Financial Conduct Authority v Arch Insurance (UK) Ltd and others. The decision is relevant to New Zealand insurers due to its rejection of the “but for” causation test in cases of loss with concurrent causes, and a clarification of the extent to which trends clauses apply in business interruption claims.

Our experts discuss the implications of these cases and more in this edition of Cover to Cover. We hope you find it an insightful and useful resource.

This issue contains eight digital articles, please follow the links below to read each one.

- Cyber losses – which insurance policy applies?

- The new financial advice regime: Ready, set, go!

- Landmark UK business interruption case: Supreme Court decision released

- Changes to class actions and litigation funding: Good news for insurers?

- Why take the chance, why not just do it? – When is a broker obliged to clarify terms with the underwriter?

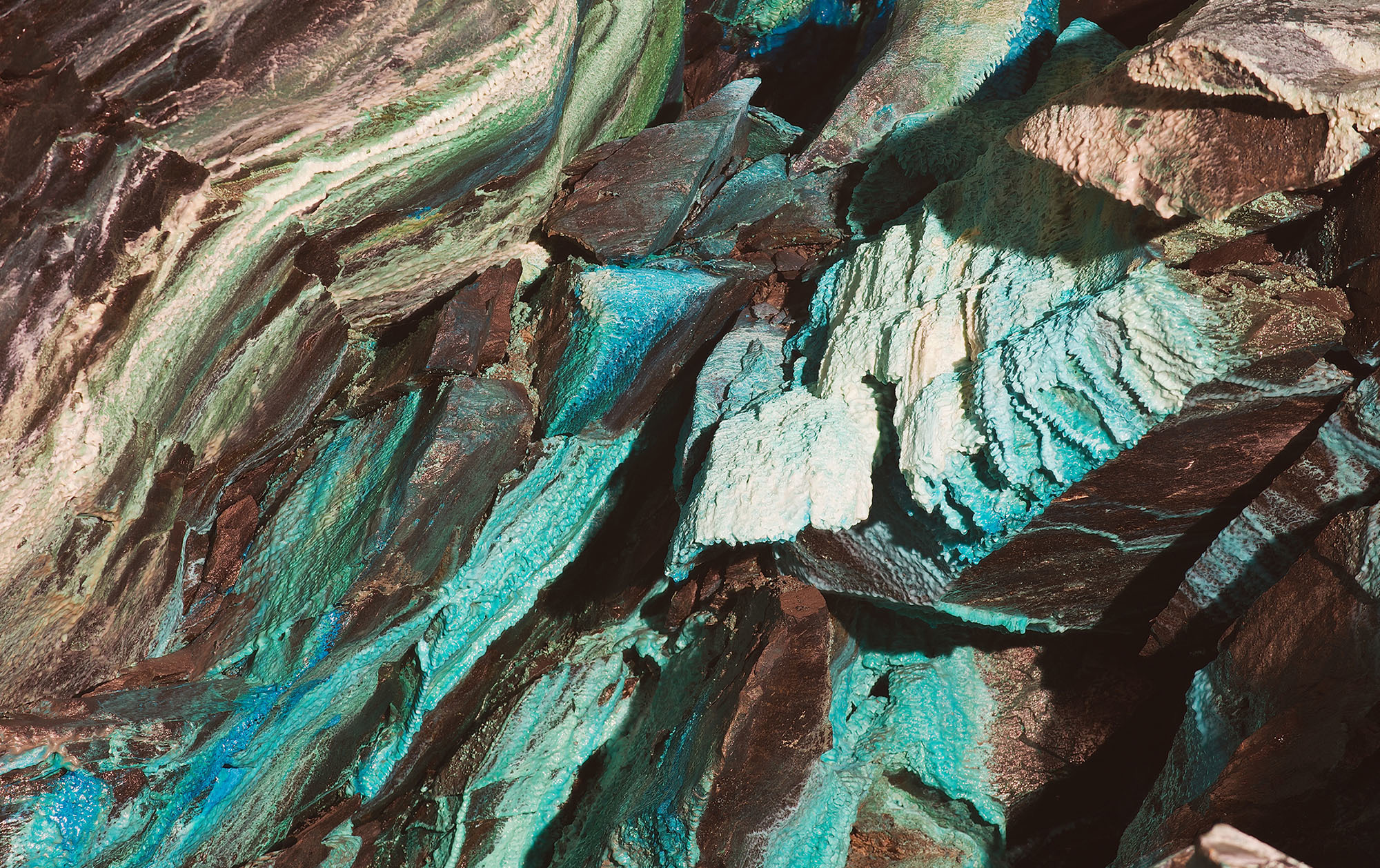

- Fake copper and fake insurance – a cautionary tale

- D&O insurance – the market continues to harden

- Judgment pins liability on insurers for defective repairs