The Government has announced a major overhaul New Zealand’s earthquake-prone building (EPB) system, with one of the headline changes being the removal of percentage of New Building Standard (%NBS) as the yardstick for seismic risk. In its place, a new EPB framework is proposed, with greater emphasis on building performance and clearer guidance for owners, occupiers, and regulators.

The reform introduces new categories that focus on consequence and context rather than a single %NBS figure, as part of a broader “risk-based” approach to seismic assessment. High-risk building types (such as those with unreinforced masonry and older concrete structures three storeys or higher) in medium- and high-seismic zones will remain subject to strengthening obligations. In contrast, low-risk regions (including Auckland, Northland and the Chatham Islands) will fall outside the system entirely. Smaller towns will see remediation obligations narrowed to façade and parapet safety, and councils will be given greater discretion to extend remediation deadlines by up to 15 years.

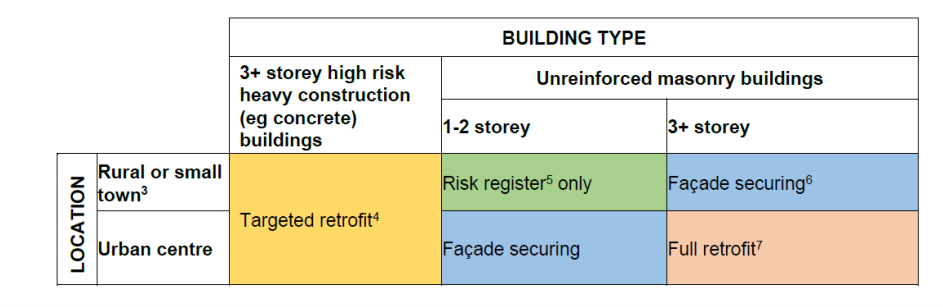

The below table shows the proposed mitigation categories of the reform, as explained in further detail here. Read more in the Ministry of Business, Innovation and Employment’s review paper here.

While the reforms aim to provide creating greater certainty, the transition raises immediate legal questions. Many contracts (mainly leases, but also sale and purchase agreements and financing arrangements) currently hardwire %NBS thresholds into clauses relating to termination rights or obligations to strengthen. Similarly, a wide range of corporate policies use %NBS as benchmark for occupancy or investment decisions.

While the reforms aim to provide creating greater certainty, the transition raises immediate legal questions. Many contracts (mainly leases, but also sale and purchase agreements and financing arrangements) currently hardwire %NBS thresholds into clauses relating to termination rights or obligations to strengthen. Similarly, a wide range of corporate policies use %NBS as benchmark for occupancy or investment decisions.

Once %NBS is retired as an official measure, a gap may emerge between legal documents, internal policies and the new statutory framework - particularly if market practice adapts quickly. This need not be fatal: engineers will still be able to provide %NBS assessments, and some legal documents will contain wording broad enough to flex with the change.

Still, property owners, occupiers and investors should be alert to the key issues, including:

-

Property transactions: Existing %NBS-linked clauses could become meaningless. For example, in the case of a standalone %NBS warranty, will occupiers and purchasers still be motivated to pursue a perceived breach? If so, how should they frame their loss in a market that may soon follow the more balanced approach proposed by the Government? Building owners should review existing contractual obligations and consider a revised portfolio strategy. Both owners and occupiers should prepare to update their precedent forms of lease.

-

Financing: Banks and insurers that reference %NBS in covenants or underwriting criteria will need to recalibrate, which could affect deal timing and feasibility.

-

Governance: Boards and senior management teams relying on %NBS as part of risk frameworks will require updated, legally robust benchmarks that align with the new regime. Building owners and occupiers should consider updating their policies as part of the broader public transition to the new risk-based EPB framework. Seismic policies that focus on site specific risk assessments will adapt more readily than those based on a strict %NBS framework.

The Government’s intent to provide clearer public communication will be helpful during this transition. A genuine public education effort that explains what the new measures mean, and what they do not mean - will be critical to restoring confidence in the system. After years of confusion, stakeholders deserve seismic rules that are not only stable, but also properly understood.

If you own or occupy a building that may be affected by this reform, contact one of our experts.

This article was co-authored by Georgie Gilbert (Solicitor) from our Property team.