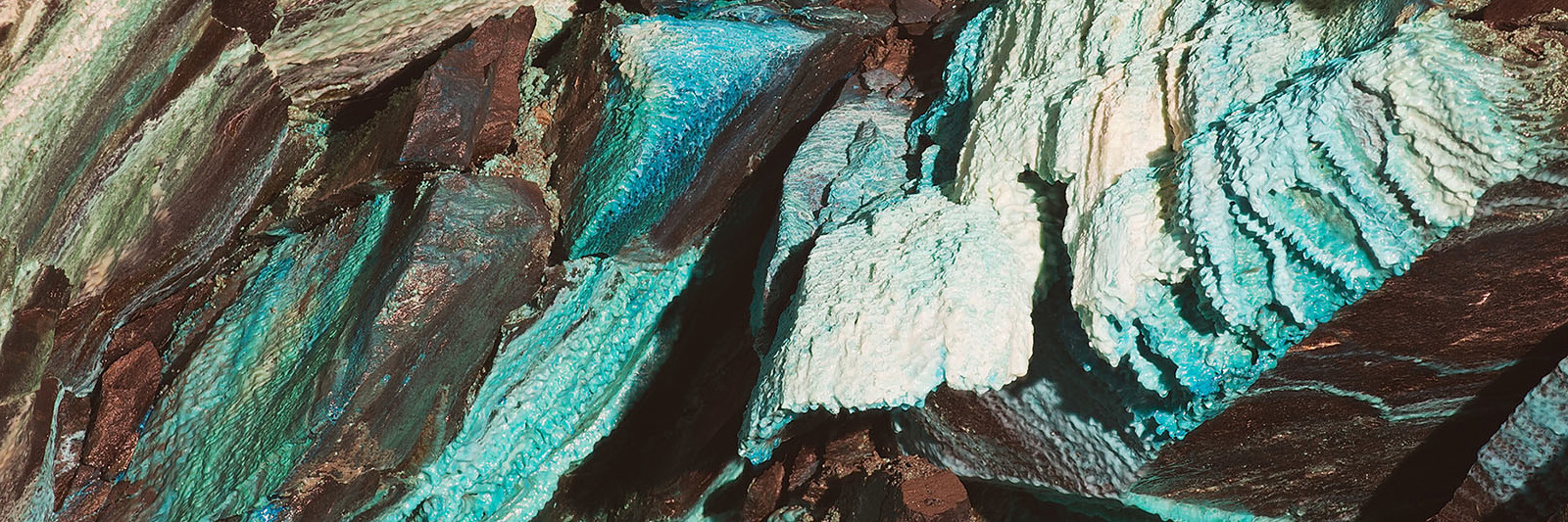

Mercuria Energy Group is a large Swiss commodities trader. Last year, it purchased US$36 million of copper from Bietsan, one of its existing suppliers in Turkey, for delivery in China. The transaction seemed unexceptional. Unfortunately, when the cargoes arrived in China, it was discovered that the containers held not semi-refined blister copper, but paving stones that had been roughly spray-painted to look something like copper. They could not have passed more than a cursory inspection.

It seems that the copper, about 6,000 tonnes in more than 300 containers, was exchanged for the stones before their journey from Turkey to China began. The copper was initially loaded into containers, where it was surveyed by an inspection company and the containers were sealed to prevent fraud. However, it appears that the containers were then opened and the copper replaced with the paving stones, following which the containers were re-sealed with fake seals. This was done for a number of shipments which left port every few days.

Once the ships were all at sea, Mercuria paid the US$36 million price. The fraud was discovered only when the first few ships arrived in China.

It was not Mercuria’s first experience of lost metal. In 2014 and 2015, it was obliged to recognise provisions for potential losses after metal warehoused in a Chinese port was seized by authorities who were investigating fraud. It no doubt believed that it had put appropriate security measures in place.

Once the ships were all at sea, Mercuria paid the US$36 million price. The fraud was discovered only when the first few ships arrived in China.

Normally, in cases of theft, a trader could make a claim upon its cargo insurance policy. Unfortunately for Mercuria, it discovered that it had been doubly defrauded. Only one out of seven cargo insurance policies arranged by Bietsan was real – the rest had been forged.

The case highlights both commodity traders’ vulnerability to fraud and their risks if adequate insurance is not in place. Had Mercuria been properly insured for the loss, the burden would have fallen upon its insurers.

Mercuria is now left to seek recovery against Bietsan in the Turkish courts and in UK arbitration, as well as making a formal criminal complaint with the Turkish authorities.

Had Mercuria sought verification from the insurers that each of the policies upon which it relied were real, it might have avoided the loss altogether. This is a cautionary tale for those who would rely upon proof of insurance that is not provided or verified directly by the insurer.