Yesterday, the Reserve Bank of New Zealand (RBNZ) released a consultation document exploring the introduction of “digital cash” as a new form of central bank-issued money, in addition to physical cash (in the form of banknotes and coins) and the electronic money in bank accounts.

The present consultation follows previous work done by the RBNZ since 2021 as part of the “Future of Money” consultation. RBNZ has not yet decided whether to issue digital cash.

The consultation aims to gather public feedback on:

- the objectives and benefits of digital cash;

- the strategic design of digital cash and its ecosystem, including governance arrangements; and

- the potential impacts of digital cash on the wider financial system.

Links to the consultation document and submissions page can be found here and here.

Who should read this? Why?

The consultation will be of interest to all participants in the financial services industry, as the proposed introduction of digital cash are significant and wide-ranging. Banks and deposit takers will likely be the most immediately impacted, as they may lose deposits and liquidity due to the issuance of digital money. The proposal will also be of interest to the general public, who will be the users of the proposed digital cash.

What does it cover?

The proposed digital cash will be an electronic version of physical cash, issued by the RBNZ, but it would not

replace physical cash.

In RBNZ’s view, the two objectives of digital cash are to:

- ensure that central bank money is available to New Zealanders and allow it to be used digitally; and

- contribute to the innovation, efficiency and resilience of New Zealand’s money and payments ecosystem.

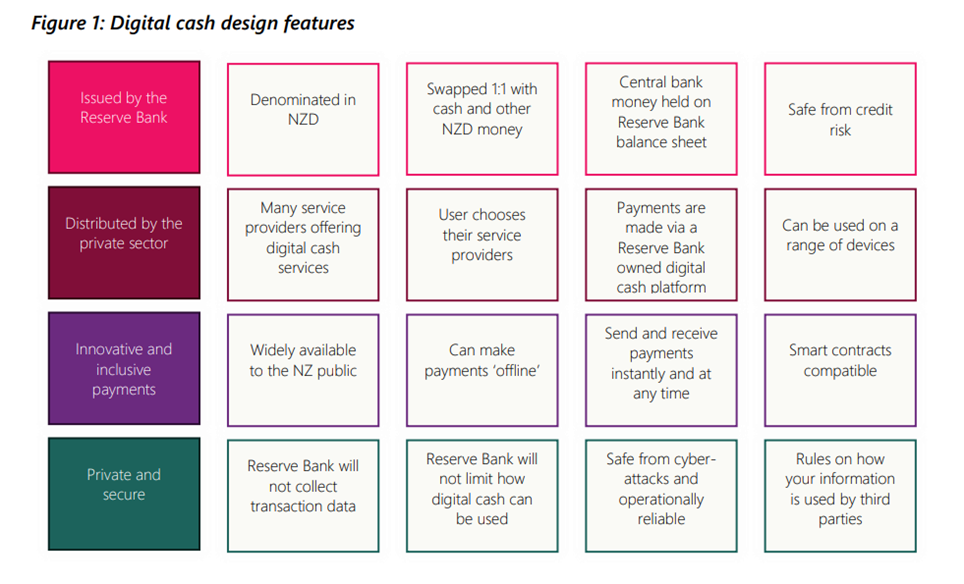

Figure 1 of the consultation paper, below, summarises the key proposed features [1].

Informed by six core digital cash principles that RBNZ has identified, high-level strategic design options have been developed, which are summarised below.

| Principles | RBNZ’s strategic design choices |

|---|---|

| Uniform Same dollar value as cash and bank deposits. |

|

| Universal and inclusive Everyone will be able to use it for everyday payments and savings, even if they don’t have a bank account. |

|

| Private Information will be kept private, and not influenced by the RBNZ when using digital cash. RBNZ will collect as little data as possible and won’t be able to access personal information or how users spent their money. |

|

| Innovative Digital cash will be innovative and support new and improved ways to make payments. |

|

| Reliable Digital cash will be resilient (can be recovered quickly if it’s exposed to risks or outages) and safe (protected from things like failures and cyber-attacks). |

|

| Orderly Digital cash will be issued in an orderly way to minimise disruption to the financial system and economy. |

|

Our view

We believe that New Zealand’s payment landscape will benefit from more innovation. RBNZ should continue to explore the potential benefits of new forms of digital money for New Zealand, acknowledging that a comprehensive cost benefit analysis will be needed before finally proceeding.

There remains much work to be done. Although the consultation document sets out high-level design concepts, the devil is in the details. We appreciate the RBNZ’s acknowledgment that “There are many details to work out before we can decide if digital cash is right for New Zealand, and we plan to consult again in the future on whether we should go ahead and issue digital cash”.

We encourage all interested parties to engage with the consultation processes. The feedback provided to the RBNZ will likely strongly influence whether and how it proceeds with its proposal.

*Disclosure – MinterEllisonRuddWatts Partner Jeremy Muir is a member of RBNZ's advisory group in relation to development of its digital cash proposals.

What next?

The consultation is open until 26 July 2024.

You can provide feedback on the consultation by taking an online survey or by written submission.

If you have any questions, please reach out to one of ours experts.

This article was co authored by Ken Ng, Associate, and William Ma, Solicitor, in our Financial Services team.

Footnotes

[1] Digital cash in New Zealand, page 7.