The climate-related disclosures (CRD) regime is in full swing, with the first climate statements for reporting periods that started on 1 January 2023 due to be published by 30 April 2024.

The Registrar of Companies has opened the Climate-related Disclosures Register and as at 9am today four climate statements have been filed, for entities with calendar reporting periods. Not all of the approximately 180 entities expected to be climate reporting entities (CREs) have yet been named on the Register, but it still provides an indicative list of the wide range of entities involved.

We have been helping a number of clients with their climate-related disclosure obligations and first climate statements, including, by providing external legal reviews. In this article we set out some of our insights, re-occurring themes and issues we have been seeing, and how we can assist.

Legal review of climate statements

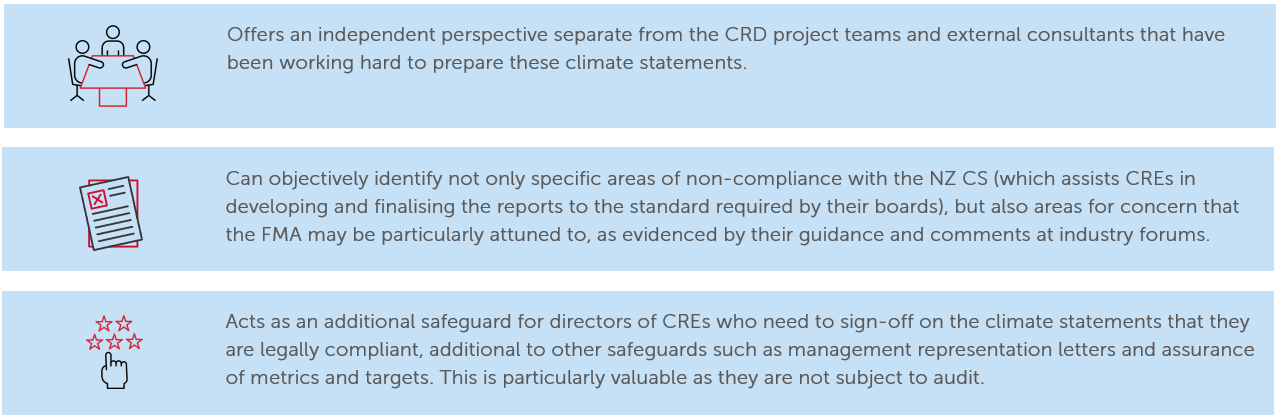

With preparation of climate statements well underway, we have been undertaking external legal reviews of these climate statements for a number of CREs. The purpose of these reviews is to ensure compliance with Part 7A of the Financial Markets Conduct Act 2013 (FMCA) and the XRB’s Aotearoa New Zealand Climate Standards (NZ CS), and also to identify any statements which on their face create a risk of ‘greenwashing’.

External legal review

Our insights

To date, we have observed varying degrees of understanding about the CRD regime and the NZ CS and varying degrees of detail, both of which have flowed through to the content of the climate statements.

While the approach to reporting has been significantly varied across different entities, we have spotted a number of similar issues:

- Which entities in a group are CREs and how many climate statements a group must file: Part 7A of the FMCA has specific provisions that are not always easy to follow about which entities in a corporate group need to file. For example, while a parent company that is a CRE must file a climate statement which includes its subsidiaries, that does not exempt a subsidiary which is, in its own right, a CRE also filing its own climate statement. Further, some the New Zealand operations involve both a branch and a locally incorporated subsidiary – both of which could be CREs. These structures can pose a significant challenge for understanding how to comply with the CRD requirements.

- Reporting fund-by-fund versus scheme-by-scheme: Large MIS manager CREs are required to report in relation to each of the funds in their registered schemes, and are permitted to combine the climate statements into a single document on a scheme basis. However, the legislation does not allow managers to also combine the reporting for two separate schemes (for example, KiwiSaver and Investment Funds) into one climate statement.

- Governance: disclosing a clear governance structure that clearly sets out how the governance body is overseeing climate-related risks and opportunities and engaging with management. This pillar is not siloed and should be integrated into all aspects of the CRD process. These disclosures will also serve as an illustration of how the board directors are fulfilling their climate-related duties.

- Scenario analysis: NZ CS 1 has prescribed a 1.5 degrees, 3 degrees or greater, and a third temperature scenario, and the FMA’s Information Sheet sets out further expectations. Scenario narratives must not simply read as a series of assumptions about a future state at the scenario time horizon. Instead, they should also describe the causes and effects of events and outcomes that form a particular pathway that led to that future. Climate statements also need to be clear that these are not predictive (or “ambitions”). Any other metrics used in this section should not be displayed in a way that may confuse primary users as to the temperature of each scenario.

- Metrics & Targets: climate statements must disclose any targets used to manage climate-related risks and opportunities (e.g. greenhouse gas emission targets), and performance against such targets. Targets must not be purely aspirational. If there isn’t a realistic action plan to achieve these (including the use of interim targets for long-term time horizons), then disclosing this target in the climate statements could be misleading and/or deceptive.

- CRD versus broader ESG: the CRD regime has prescribed requirements that relate exclusively to climate-related issues. To the extent that a CRE wants to include material related to its broader environmental, social and governance initiatives, it needs to be very clear as to its relevance to, and that it does not distract from, the prescribed disclosure. More generally, CREs should make sure that their other ESG disclosures (e.g. in the annual report, investor presentations and on websites) are consistent with their CRD disclosure.

CREs should not underestimate the need to ensure that any statements made in the climate statements do not amount to ‘greenwashing’ – though not directly related to the CRD regime, we consider this to be one of the most significant issues we have encountered.

CREs are required by NZ CS to report on the effects of climate change on their business or funds, and what they plan to do in terms of both adaptation and mitigation (there is an exemption for transition plans in year one). During our reviews, we have found that some of these statements, while well-meaning, carry at least some level of risk of greenwashing. It is crucial that CREs are able to substantiate every claim made in climate statements.

Other recent work with CREs

In addition to reviewing climate statements, we have been assisting CREs with other CRD-related workstreams such as:

Please get in touch with one of our experts below if you’d like to find out more about how we can help your business with its climate-related disclosures obligations.

This article was co-authored by Hannah Cross, a Solicitor in our Banking and Financial Services team.