Doing business with Russia became even more difficult last week after the New Zealand Government imposed its most significant round of sanctions in response to Russia’s invasion of Ukraine.

This round of sanctions introduced immediate asset freezing obligations and prohibitions on dealings with 18 major Russian banks and financial institutions. From 25 April 2022, it also introduced a 35% tariff on all New Zealand imports from Russia, and a prohibition of New Zealand exports to Russia and Belarus of products that are closely connected to strategic Russian industries, including certain machinery, electronics, base stations, motor vehicle parts, and leisure vessels.

The latest round of sanctions also modified some of the Government’s existing measures targeting Russia. Most notably, it introduced a (warmly welcomed) exemption to permit New Zealanders to hold or dispose of sanctioned Russian shares or other securities, so long as any disposal does not benefit a sanctioned person. It also increased the threshold beyond which a sanctioned person is deemed to own or control an entity from 25% to 50%, which brings New Zealand’s approach into line with that taken by other countries.

This alert summarises the latest developments and considers their practical significance.

Who should read this?

New Zealand banks doing business with Russia; New Zealand importers of Russian goods; New Zealand exporters of strategic products to Russia and Belarus; and New Zealand ‘high value dealers’.

Russia Sanctions Amendment Regulations (No 2) 2022

New sanctions on Russian banks and financial institutions

The Russia Sanctions Amendment Regulations (No 2) 2022 (Amendment Regulations) introduced immediate asset freezing obligations and prohibitions on ‘dealings with assets’[1] and ‘dealings with services’[2] that involve Russia’s Central Bank, the Russian Direct Investment Fund, and the following 16 Russian banks: Alfa-Bank, Bank Otkritie, Bank Rossiya, Black Sea Bank for Development and Reconstruction, Credit Bank of Moscow, Gazprombank, GenBank, Industrial Savings Bank, Novikombank, Russia Agricultural Bank / Rosselkhozbank, Russian National Commercial Bank, Sberbank, SMP Bank, Sovcombank, Vnesheconombank and VTB Bank.[3]

New Zealand has now sanctioned approximately 80% of all banking assets in Russia, and many of the Russian Government entities responsible for issuing and managing Russia’s sovereign debt. Of the 10 largest Russian banks in terms of net assets (by millions of Rubles) as of December 2020, only AO Raiffesisenbank (which is Austrian-owned and in 10th place[4]) is yet to be sanctioned.

The latest bank designations will further disrupt inbound and outbound payments involving Russia; many of which are already being held in New Zealand and offshore pending enhanced sanctions due diligence. Nevertheless, New Zealand banks and creditors should remember that the Russia Sanctions Regulations 2022 (Regulations) include an express exception that allows a New Zealand person to receive money that is a restricted asset if, immediately before the restrictive sanctions were imposed, the person from whom it is received had a legal obligation to pay (whether at that time or in the future) the money to the New Zealand person.[5]

35% tariff on all imports from Russia

The Amendment Regulations also introduced a 35% tariff on all imports from Russia. Importantly, the tariff will not apply to goods that were en route to New Zealand on or before 25 April 2022[6], or to imports valued at less than NZD1,000.[7]

The 35% tariff is primarily expected to affect New Zealand importers of: mineral fuels, oils and distillation products; fertilisers; wood, articles of wood and wood charcoal; plastics; beverages, spirits and vinegar; wadding, felt, nonwovens, yarns, twine and cordage; stone, plaster, cement, asbestos, mica or similar materials; and aluminium.[8]

Prohibitions on exports of strategic goods to Russia and Belarus

The Amendment Regulations also introduced a prohibition on New Zealand persons exporting various products to Russia or Belarus, except for humanitarian purposes.[9] The prohibited exports are listed in Schedule 3. Unfortunately, the products affected have only been identified using four to six digit HS codes, which makes it harder for interested parties to determine whether or not their exports are now prohibited.

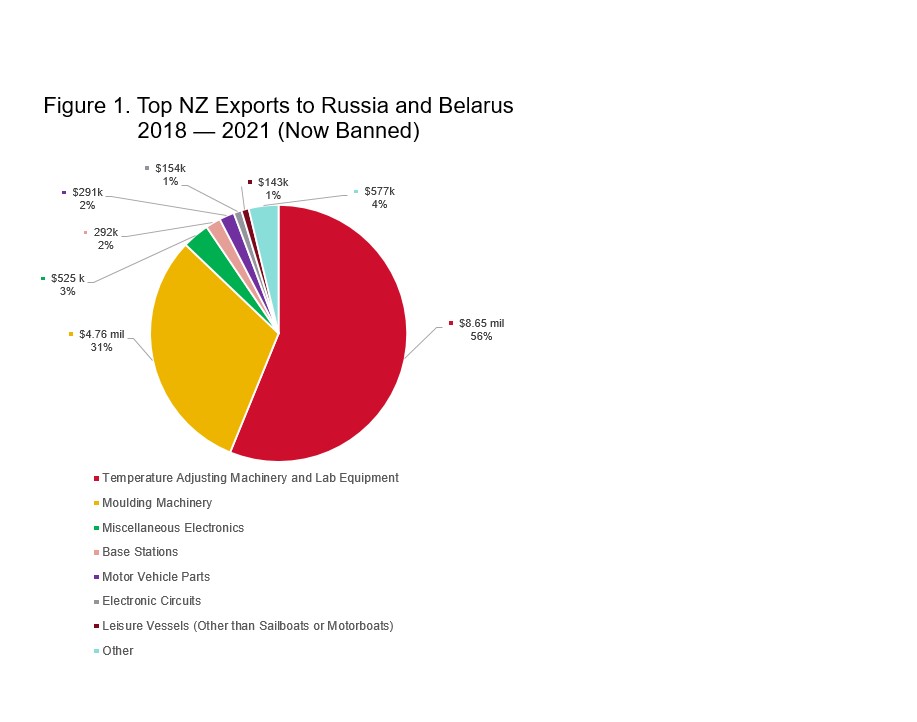

While these prohibitions will nominally affect exports of products falling under 261 HS codes, their practical affect will be more modest. This is because New Zealand only exported products to Russia and Belarus falling under 42 of these HS codes in the calendar years 2018 – 2021. Historical import data from Statistics New Zealand suggests that New Zealand exporters of certain machinery, electronics, base stations, motor vehicle parts, and leisure vessels will be most affected by the new export prohibitions (see Figure 1 below). A complete list of: affected HS codes; their related product descriptions; and their export data covering the years 2018 – 2021 is available upon request.

The new export prohibitions are in addition to the previous ban on exporting goods intended for the Russian and Belarussian military, security, and police sectors. They also complement New Zealand’s comprehensive export control scheme for the export of other controlled goods to Russia and Belarus.

Exemption for New Zealanders holding Russian securities

While the Regulations continue to generally prohibit a New Zealand person from dealing with an asset that is owned or controlled by a sanctioned person (or where the dealing would benefit a sanctioned person), this prohibition no longer applies to holders of Russian shares or other ‘securities’.[12]

The Amendment Regulations now establish that, while a New Zealand person must not acquire a sanctioned security or deal with it in any way that would benefit a sanctioned person, it may hold or dispose of such a security, as long as it is not to a sanctioned person.[13] According to the Amendment Regulations’ Explanatory Note: “This (exemption) is to provide for the scenario where a New Zealand person currently holds securities (such as shares in a sanctioned entity). It is not intended that the sanctions would prevent them from selling those shares (if they were able to find a buyer) or from continuing to hold them (which would be the likely result if they were not able to find a buyer)”.

This amendment has been warmly welcomed by a range of New Zealand investors that were (for a variety of reasons) unable to divest their Russian holdings during the initial weeks of the Russian invasion and had been contemplating how to progress since. It is also encouraging to see another example of how the New Zealand Government is both listening and responding to the well-articulated concerns of New Zealanders about the practical issues raised by its Russia sanctions regime.

Increase in ownership and control threshold from 25% – 50%

It is important to remember that the Government’s Russia sanctions regime prohibits New Zealand persons from having a broad range of dealings with both sanctioned individuals and entities, and their ‘associates’. The relevant definition of an ‘associate’ is broad and will ensure that the following persons will also be subject to New Zealand sanctions:

- a designated person’s agent;

- a designated person’s ‘senior manager’; and

- an entity that a designated person ‘owns or controls’. The original Regulations set a comparatively low 25% ownership or control threshold, but the

Amendment Regulations increased this threshold to 50%.

Identifying ‘associates’ and entities that a designated person ‘owns or controls’ is likely to prove difficult for some New Zealand corporates that do not conduct rigorous customer and transaction due diligence processes. However, the task will be somewhat easier with the new 50% threshold, as it brings New Zealand into line with the approach taken in similar jurisdictions. For example, the United States Office of Foreign Assets Control applies a ‘50 Percent Rule’, which states that parties are subject to blocking sanctions if they are directly or indirectly owned 50% or more, in the aggregate, by one or more blocked parties.

New persons declared ‘duty holders’

The Amendment Regulations also extend the class of ‘duty holders’ under the Russian Sanctions Act 2022 (Act) to any person who is in trade and is buying or selling any of the listed classes of items where the total value of the relevant transaction (or series of transactions) is equal to or above NZD10,000. The items include jewellery, watches, precious metals and stones, artworks, motor vehicles and ships.[14] Where a ‘duty holder’ is in possession or control of assets and suspects on reasonable grounds that these assets may be subject to the sanctions measures, they have a duty to report that fact to the New Zealand Police Financial Intelligence Unit (FIU).

Any New Zealand business engaged in trading any of the listed items should familiarise themselves with the Government’s Russia sanctions regime and the FIU’s guidance on reporting.[15]

How can we help?

We have extensive experience of advising on sanctions compliance and enforcement related matters, including in relation to Western governments’ recent sanctions targeting Russia. We routinely assist clients to: produce obligations registers; conduct compliance assessments; undertake customer and transaction due diligence and screening processes; structure low risk transactions; and develop or refine sanctions compliance programmes.

Members of our team have represented clients in sanctions investigations undertaken by the New Zealand Customs Service, the UN, and the UK and US governments. We have also represented clients in sanctions-related mediations and judicial proceedings in New Zealand and the UK.

We work closely with partner firms in other jurisdictions, including the Asia-Pacific-wide network of MinterEllison offices, when foreign legal advice is required.

This article was co-authored by Danielle Cooper, a Law Clerk in our Public Law team.

Footnotes

[1] Russia Sanctions Act (Act), s 5 (dealings with assets).

[2] Ibid, s 5 (dealings with services).

[3] Amendment Regulations, rr 10 and 11, and Schedule 2.

[4] See: https://en.wikipedia.org/wiki/Banking_in_Russia#:~:text=%22Sberbank%22%20continues%20to%20this%20day,present%20Russian%20government’s%20banking%20business.

[5] Regulations, r 12(3).

[6] Amendment Regulations, Schedule 1, Part 1.

[7] See: https://www.mfat.govt.nz/en/countries-and-regions/europe/ukraine/russian-invasion-of-ukraine/sanctions/.

[8] See: New Zealand Imports from Russia – 2022 Data 2023 Forecast 1992-2021 Historical (tradingeconomics.com).

[9] Amendment Regulations, Part 2.

[10] See: Export Controls (Export Prohibition to Specified Places) Notice 2022 (No 2) – 2022-go899 – New Zealand Gazette.

[11] See: Which goods are controlled? | New Zealand Ministry of Foreign Affairs and Trade (mfat.govt.nz).

[12] Amendment Regulations, r 10A(3) (‘Security of a sanctioned person’).

[13] Amendment Regulations, r 10A.

[14] Amendment Regulations, r 19.

[15] See: https://www.police.govt.nz/sites/default/files/publications/sanctions-alert-fiu-2022-sanc02.pdf.

Key contacts

Speak with one of our experts.