Earlier today, the New Zealand Government imposed sanctions on 36 individuals with close ties to the Russian Government, including some of Russia’s richest businesspeople, as well as the chairs, chief executives and major shareholders of some of Russia’s biggest companies. The sanctions prohibit New Zealand persons from having a broad range of dealings with the 36 individuals, as well as the individuals’ associates, agents, senior managers and entities they own or control.

This alert summarises the New Zealand Government’s sanctions targeting Russia and considers what further measures may follow in the coming weeks. It also explains the practical implications of New Zealand and foreign governments’ sanctions for New Zealand businesses with links to the Russian market.

Who should read this?

New Zealand corporates (and notably banks) doing business with Russia, and especially those dealing with Alfa Group, Bank Rossiya, Gazprom, Metalloinvest, Reneva Group, Rostec, the Russian Direct Investment Fund, Severgroup, Sheremetyevo International Airport, Transneft and United Company RUSAL.

Second tranche of sanctions targeting Russian oligarchs and their ‘associates’

As part of the New Zealand Government’s ongoing response to Russia’s invasion of Ukraine, new sanctions targeting 36 individuals with close ties to the Russian Government or the Russian President came into force today.

The targets include some of Russia’s richest businesspeople (including Roman Abramovich), as well as the chairs, chief executives and major shareholders of some of Russia’s biggest companies (including Alfa Group, Bank Rossiya, Gazprom, Metalloinvest, Reneva Group, Rostec, the Russian Direct Investment Fund, Severgroup, Sheremetyevo International Airport, Transneft and United Company RUSAL).

These individuals (and some of their close family members) are now ‘designated persons’ who will not be able to travel to New Zealand, move assets here, deal with assets already here, or use the country’s financial systems to circumvent sanctions that may be imposed by other countries in the future.

It is important to remember that this second tranche of sanctions also prohibits New Zealand persons from having a broad range of dealings with these 36 individuals and any of their ‘associates’. The relevant definition of ‘associate’[1] is broad and will ensure that the following persons will also be subject to New Zealand sanctions:

- a designated person’s agent;

- an entity that a designated person ‘owns or controls’[2] (applying a comparatively low 25% ownership or control threshold); and

- a designated person’s ‘senior manager’[3].

Identifying ‘associates’ and entities that a designated person ‘owns or controls’ is likely to prove difficult for some New Zealand corporates that do not conduct rigorous customer and transaction due diligence processes.

First tranche of sanctions targeting Russian political and military persons

This is the second tranche of sanctions imposed under the Russia Sanctions Act 2022 (Act). The first tranche was introduced on 18 March 2022, when the Government made the Russia Sanctions Regulations 2022 (Regulations), which includes a Schedule of sanctioned persons. Our earlier alerts on the Act and the Regulations are available here and here.

The first tranche of sanctions prioritises political and military individuals and entities. It extends pre-existing sanctions on the Russian President, Prime Minister, Foreign Minister, Defence Minister and nine further members of the Russian Security Council to include asset freezes and prohibitions on their vessels and aircraft entering New Zealand. It also prohibits dealings in services that involve 18 military entities and one Russian state-backed bank, Promsvyazbank (PSB). It also adds 364 individuals to New Zealand’s travel ban list.

A full list of the individuals and entities impacted by the sanctions are detailed on MFAT’s website. MFAT has also published Q&As on the sanctions. The New Zealand Police Financial Intelligence Unit (FIU) has published guidance for reporting entities under the Act.

Further sanctions will be enacted in coming weeks

In announcing the second tranche of sanctions, Foreign Minister Nanaia Mahuta said: “Officials continue to work as quickly as possible to identify individuals and entities, while ensuring legal thresholds are met and due diligence is given. More measures will be enacted in the coming weeks”.

Further sanctions on Russian banks?

When the Act was passed, the Government signalled that the first tranche of sanctions would include immediate asset freezes and sanctions on Russian banks. Despite this, only one Russian bank (PSB – a bank few New Zealand persons are likely to deal with) has been included to date.

Many expect the New Zealand Government will soon target some or all of the 11 Russian banks and government entities sanctioned by Australia on Friday 18 March 2022. The additional banks together account for approximately 80 per cent of all banking assets in Russia, and include Sberbank, Gazprombank, VEB, VTB, Rosselkhozbank, Sovcombank, Novikombank, Alfa-Bank and Credit Bank of Moscow. The additional entities include the Russian National Wealth Fund and the Russian Ministry of Finance. When considered alongside the earlier targeting of the Central Bank of Russia, Australia’s sanctions now target all Russian Government entities responsible for issuing and managing Russia’s sovereign debt.

The big picture

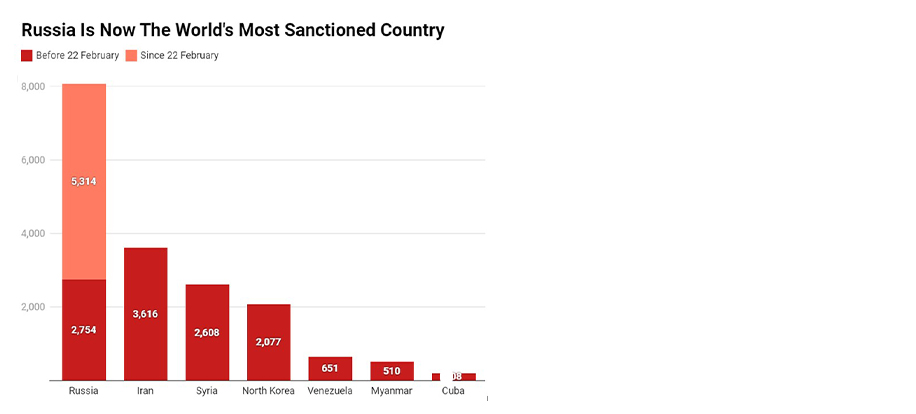

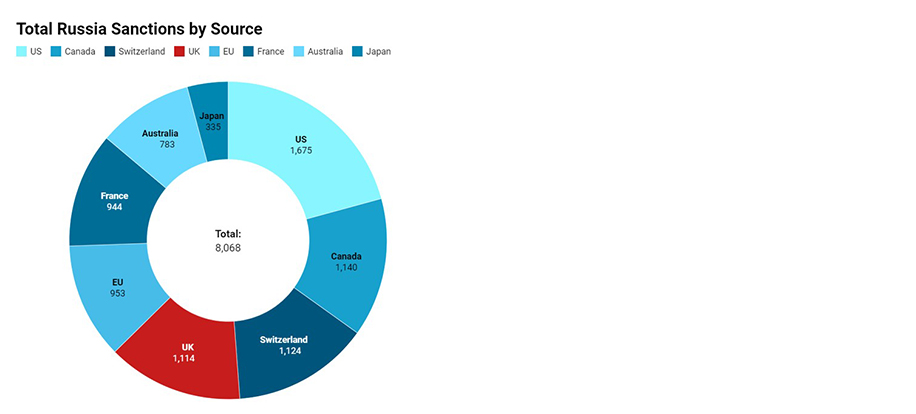

Russia is now the world’s most sanctioned country; with almost as many designated persons as Iran, Syria and North Korea combined (see Figure 1 below)[4]. While eight jurisdictions have imposed a comprehensive package of autonomous sanctions on Russia (see Figure 2 below)[5], it is the United States (US) and Australian governments’ unilateral sanctions measures that are causing most headaches for New Zealand businesses. This is due to the prominence of the US dollar (and hence involvement of the US financial system) in Russia: New Zealand payment flows, and the level and nature of Australian investment in New Zealand’s banking sector.

Since Russia’s invasion of Ukraine began, over 500 of the world’s leading companies have announced their withdrawal from Russia[6], as have many New Zealand corporates.

Figure 1. Russia is now the world’s most sanctioned country

Figure 2. Total Russia sanctions by source

How can we help?

We have extensive experience of advising on sanctions compliance and enforcement related matters, including in relation to Western governments’ recent sanctions targeting Russia. We routinely assist clients to: produce obligations registers; conduct compliance assessments; undertake customer and transaction due diligence and screening processes; structure low risk transactions; and develop or refine sanctions compliance programmes.

Members of our team have represented clients in sanctions investigations undertaken by the New Zealand Customs Service, the UN, and the UK and US governments. We have also represented clients in sanctions-related mediations and judicial proceedings in New Zealand and the UK.

We work closely with partner firms in other jurisdictions, including the Asia-Pacific-wide network of MinterEllison offices, when foreign legal advice is required.

This article was co-authored by Nathalie Harrington, a Senior Solicitor in our Public Law team.

Footnotes

[1]. Regulations, r 5(2), definition of ‘associate’.

[2]. Regulations, r 5(3).

[3]. Regulations, r 5(4).

[4]. See: https://www.castellum.ai/russia-sanctions-dashboard

[5]. Ibid

[6]. See: https://som.yale.edu/story/2022/over-500-companies-have-withdrawn-russia-some-remain

Key contacts

Speak with one of our experts.