Themes that defined this year

Last year, we reflected on 2022 being a time defined by widespread labour shortages and the “great resignation” encouraging many businesses to turn their focus to retaining talent by way of equity incentives. With the re-opening of borders post-Covid, in 2023, there has been huge movement, with many Kiwis moving overseas, and record numbers coming to New Zealand. Nonetheless, on the back of significant salary inflation in recent years, further increases in cash salaries will likely be difficult for many businesses.

In reflection of this, we are still seeing businesses actively implementing employee share plans with a view to incentivising and retaining the people key to the success of their business. We have also seen the upper range of CEO at-risk pay increase to 70% of face value salary from 50% last year. This would indicate greater focus on performance in light of an anticipated tougher economic environment, albeit 2023 was better than expected for businesses.

We are also starting to see ESG goals factoring into vesting conditions for long-term incentive (LTI) share awards, whereas previously the conditions were largely financial. This development likely reflects the formalisation of ESG targets in light of mandatory climate reporting, which requires disclosure of management remuneration linked to climate-related risks and opportunities.

In this round-up, we set out the key trends that are developing in relation to employee share plans based on information provided by NZX50 companies as well as our experience working with private companies.

Market trends

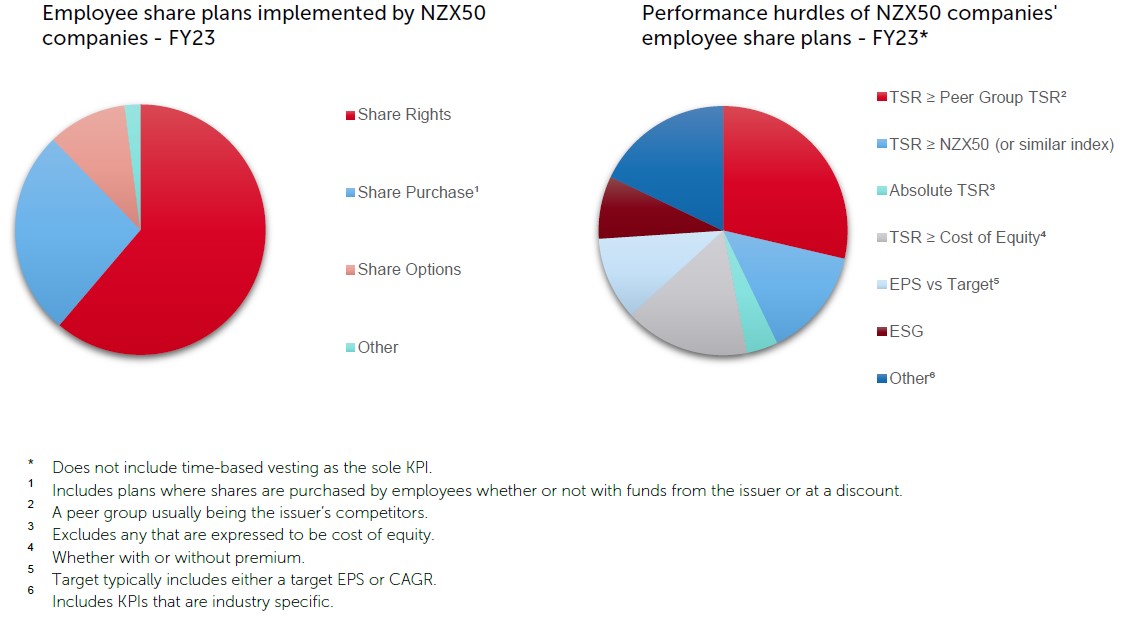

We set out below the predominant types of share plans adopted by NZX50 companies as well as the performance hurdles applying to performance awards under those plans.

Common employee share plans

Amongst NZX50 companies, performance share rights plans, where an employee has a right to acquire a share in the future for no cost, are the most common LTI plan for senior staff, with share purchase plans most common for general staff participation. Share purchase plans normally include plans to acquire shares with financial assistance (e.g. loans) or at a discount, which can be structured as tax exempt plans. From our experience working with large private companies, phantom share schemes and share purchase plans are implemented more frequently with an equity pool tending to be 5-10% of share capital.

Measuring employee performance

A challenge for any company implementing an employee share plan is determining the right performance hurdle(s) which appropriately incentivise employees. With LTI plans, the focus is ultimately to drive shareholder value in the longer term, with metrics reflecting that goal. But, in doing so, there is a natural tension between incentivising and rewarding results, while accounting for market trends affecting the company (whether for better or worse).

To account for this, most NZX50 companies adopt dual performance hurdles, one of which is absolute (i.e. looking at company performance) and one of which is relative (i.e. looking at performance against other companies). In this way, employees are incentivised to not just drive results, but results exceeding those of rivals, which also means that market trends alone are less likely to result in full vesting.

The most commonly adopted performance hurdles are based on total shareholder returns (TSR), cost of equity (COE) and earnings per share (EPS), with common pairings reflecting the above incentive drivers including:

- TSR vs Peer Group TSR paired with TSR vs COE (with or without premium); or

- TSR vs Index TSR paired with EPS vs a Target.

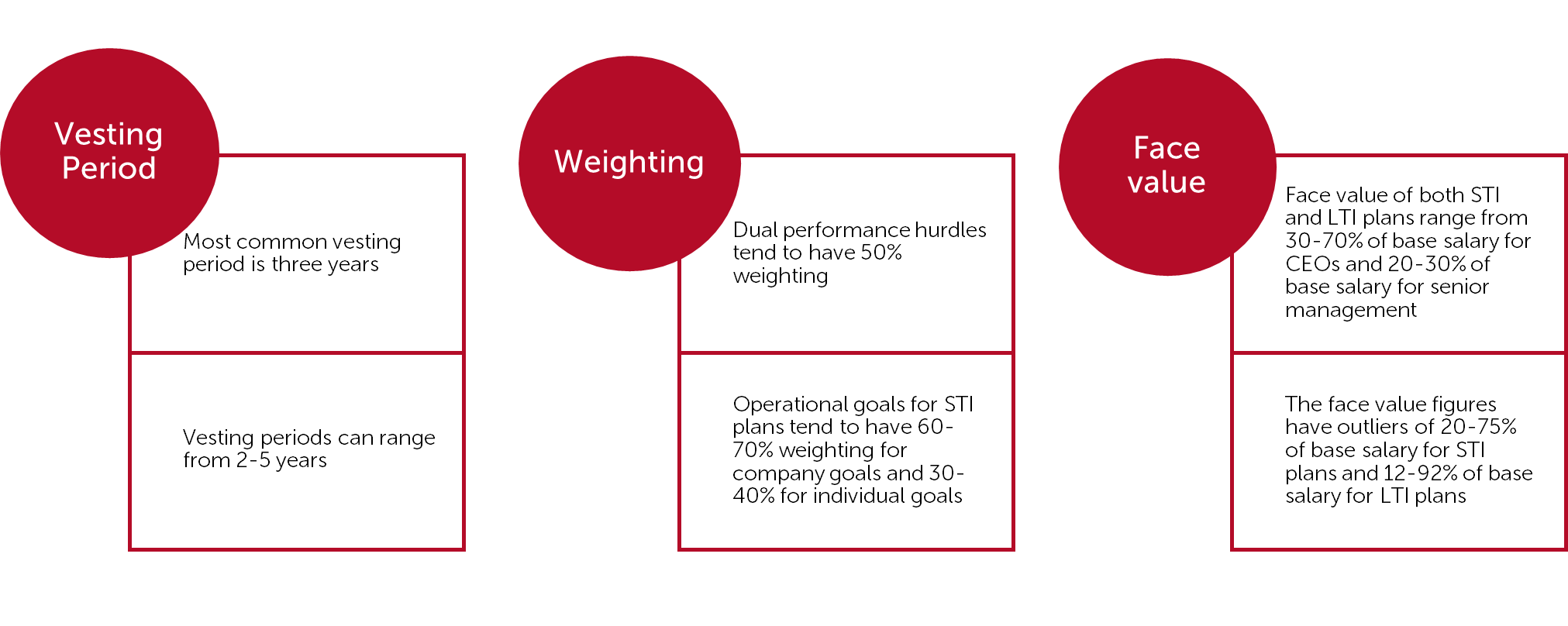

Weighting of awards is normally 50:50 between the two hurdles, so that full vesting of an award only occurs if the company beats internal targets and competitors/the market. This also reflects a general move away from having two relative performances hurdles such as TSR vs Peer Group TSR and TSR vs NZX50 or a single relative hurdle, so that staff can have more confidence around vesting. Nonetheless, despite the pressure on labour shortages, LTIs do not tend to have pure time based vesting (except for share purchase plans that are available to wider staff outside of the senior management team).

There has also been a gradual increase in the adoption of ESG goals for LTI vesting hurdles amongst the NZX50. For example, assessing the company’s progress on decarbonisation through measuring the company’s achievement of its greenhouse gas emission reduction targets. We expect that this trend will continue as mandatory climate reporting continues to be rolled out for listed companies, and they seek to formalise the same. In this respect, climate statements require disclosures on:

- how the entity’s governance body sets, monitors progress against, and oversees achievement of metrics and targets for managing climate-related risks and opportunities, including whether and if so how, related performance metrics are incorporated into remuneration policies; and

- metrics for management remuneration linked to climate-related risks and opportunities, expressed as a percentage, weighting, description or amount of overall management remuneration.

Other features of employee share plans

Tax issues for employee share plans

The tax treatment of employee share plans largely aligns with bonus schemes, simplifying tax structuring. That said, employers and employees still need to consider:

- the timing of income recognition for employees, and the corresponding deduction for employers; and

- who will account for the tax. The default position is for employees to account for the tax (raising provisional tax issues), or an employer can choose to deduct PAYE.

In addition, employee share plans are becoming a common issue for consideration in an M&A context, largely due to deemed tax deduction issues. We see some vendors and shareholders engage in debate on how to price the employer’s tax deduction.

This article was co-authored by Ronnie Duan, a Solicitor in our Corporate and Commercial team.