Themes that defined this year

Given the year that has just been, defined by widespread labour shortages and the “great resignation”, many businesses have turned their focus to retaining talent by way of equity incentives. In a time when many employees are choosing to leave New Zealand for enticing offshore offers, or are experiencing post-lockdown burnout, we are seeing many businesses implementing employee share plans with a view to incentivising and retaining the people key to the success of their business.

In this round-up, we set out the key trends that are developing in relation to employee share plans based on information provided by NZX50 companies, as well as our experience working with private companies.

Market trends

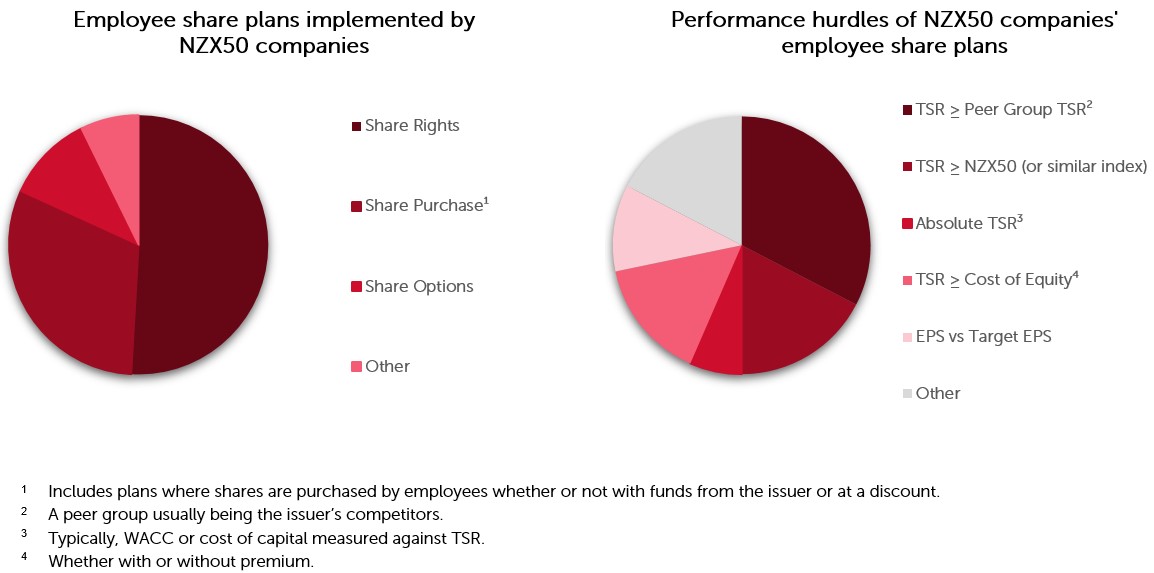

We set out below the predominant types of share plans adopted by NZX50 companies, as well as the performance hurdles applying to performance awards under those plans.

Common employee share plans

Amongst NZX50 companies, performance share rights plans (where an employee has a right to acquire a share in the future for no cost) are the most common long-term incentive (LTI) plan for senior staff, with share purchase plans most common for general staff participation (that mostly exclude directors). Share purchase plans normally include tax exempt plans, or plans to acquire shares with financial assistance (e.g. loans) or at a discount. From our experience working with large private companies, phantom share schemes and share purchase plans are implemented more frequently with an equity pool tending to be 5-10% of share capital.

Approximately 75% of NZX50 companies implement at least one LTI plan to complement their short-term incentive (STI) plans. Over the past few years, we have seen increasingly fewer companies offering two or more LTI plans. This trend has mainly been a result of companies gradually phasing out existing share loan and trust plans (as they vest) adopted under older tax rules and replacing those plans with new performance share rights plans.

Measuring employee performance

A challenge for any company implementing an employee share plan is determining the right performance hurdle(s) which appropriately incentivise employees. With LTI plans, the focus is ultimately to drive shareholder value in the longer term, with metrics reflecting that goal. But in doing so, there is a natural tension between incentivising and rewarding results, while accounting for market trends affecting the company (whether for better or worse).

To account for this, most NZX50 companies adopt dual performance hurdles, one of which is absolute (i.e. looking at company performance) and one of which is relative (i.e. looking at performance against other companies). In this way, employees are incentivised to not just drive results, but results exceeding those of rivals, which also means that market trends alone are less likely to result in full vesting.

The most commonly adopted performance hurdles are based on total shareholder returns (TSR), earnings per share (EPS) and cost of equity (COE), with common pairings reflecting the above incentive drivers including:

- TSR vs Peer Group TSR paired with EPS vs a Target EPS; or

- TSR vs Peer Group TSR paired with TSR vs COE (with or without premium).

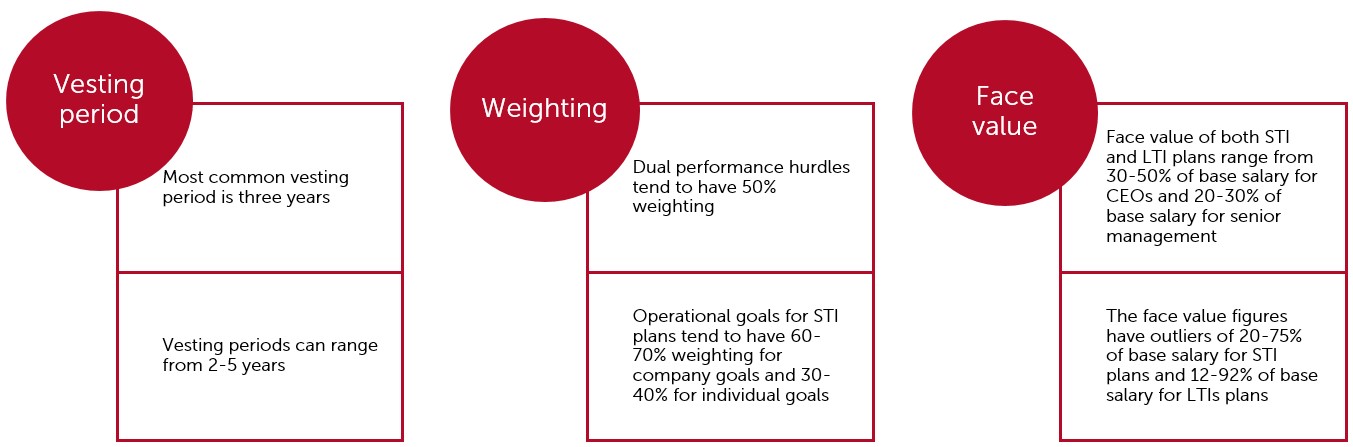

Weighting of awards is normally 50:50 between the two hurdles, so that full vesting of an award only occurs if the company beats internal targets and competitors. This also reflects a general move away from having two relative performances hurdles such as TSR vs TSR Peer Group and TSR vs NZX50, or a single relative hurdle, so that staff can have more confidence around vesting. Nonetheless, despite the pressure on labour shortages, LTIs do not tend to have pure time based vesting.

Other features of employee share plans

Tax issues for employee share plans

The tax treatment of employee share plans now largely aligns with bonus schemes, simplifying tax structuring. That said, employers and employees still need to consider:

- the timing of income recognition for employees, and the corresponding deduction for employers; and

- who will account for the tax. The default position is for employees to account for the tax and there has been a recent draft IRD publication considering the provisional tax issues where an employer has chosen not to deduct PAYE.

In addition, employee share plans are becoming a common issue in an M&A context, largely due to the new deemed tax deduction changes. We are now seeing some vendors and shareholders engage in debate on how to price the employer’s tax deduction.

What to expect looking forward

With depressed share prices in the current economic conditions, many older awards will be less likely to vest due to factors outside the company’s control, which will have an impact on retention risk and likely prompt conversations on renegotiating grants.

Going forward, companies also need to be wary of incentive mismatch or failure to incentivise employees due to awards vesting based on general market conditions and irrespective of individual employee performance. Namely, awards that are granted now (and upon lower share prices) will be more likely to vest when the market recovers, increasing the risk of vesting without relative performance.

Accordingly, employee share plans that incorporate solely or predominantly absolute performance metrics may lead to an incentive mismatch. We would therefore expect more companies to adopt relative performance metrics together with absolute performance metrics that factor in turnaround goals where the company is under financial stress. We would also expect awards granted now to have a greater retention impact, given the plans are based on depressed share prices.

Achieving the appropriate mix of performance hurdles and incentives remains a delicate balancing act between appropriate incentives and ensuring that employees have comfort that their performance will be measured and rewarded fairly. With economic headwinds expected in 2023, and the wide degree of options available, this will continue to be a difficult yet important task for Boards to navigate in the year ahead.

This article was co-authored by Ronnie Duan, a Solicitor in our Corporate and Commercial team.