While the term originated in the mining industry, its applicability now spans multiple business sectors. Today, SLO refers to an entity’s ability to do business because society has confidence that it will act in socially and environmentally acceptable way, transcending the need for legal and regulatory compliance alone, and taking into account a wider group of stakeholders (such as the environment). This world view is having a real impact on enforcement priorities and decisions. In the financial sector alone, this new focus may be credited (at least in part) with significant remediation payments of over $150m back to customers. It’s clear that regulators want to make good conduct and culture worth the mahi – financially, as well as socially and culturally.

With economic commentators forecasting macro-economic headwinds in 2023, there will be heightened sensitivity to conduct which is inconsistent with a business’ SLO. Moreover, inadvertent activity which might previously have been excused (provided it was reported and fixed quickly) seems to increasingly be fodder for investigation and enforcement by regulators. The justification for regulatory action is that under-investment, or lack of due diligence regarding systems and controls, leads to poor outcomes for customers and stakeholders, and is at odds with the business’ SLO.

We discuss how these themes have been demonstrated by the regulators, and what we can expect for 2023.

Financial Markets Authority (FMA)

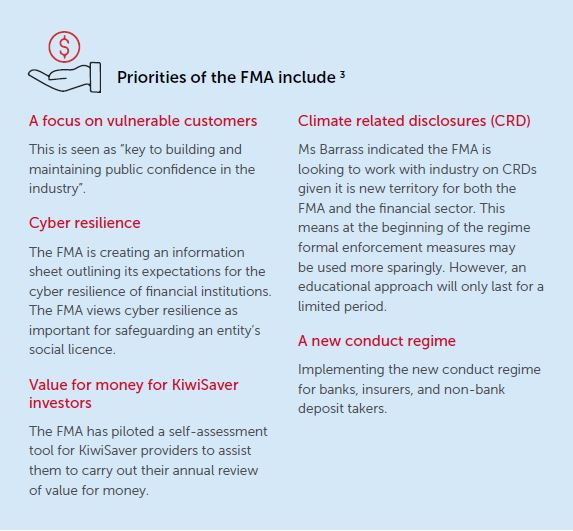

Samantha Barrass, Chief Executive of the FMA, has emphasised that the regulator’s approach is about achieving fair outcomes for markets and consumers. The reference to “fair” outcomes rather than just “compliant outcomes” shows that an entity’s SLO is now embedded in the FMA’s thinking. This is also reflected in the FMA’s expanded regulatory remit via the Conduct of Financial Institutions legislation, which will “put fair treatment of customers at the heart of their business model” [1].

An approach that takes into account broader conduct issues rather than focussing wholly upon whether specific regulatory obligations have been breached has been in development in recent years. In the FMA’s Supervision Insights report of September 2020, which provided an overview of its supervision activities with respect to regulated entities, the FMA expressed the view that “entities need to think and act beyond minimum legal and regulatory standards, and champion business models that focus on customer interests.” The FMA also indicated that it did not intend to await legislative developments before taking action against conduct that might harm consumers, reporting that “while we are awaiting a legislative framework for banking and insurance, we are at a point now where the volume of available guidance, level of engagement and maturity of the regulatory regime mean there are no excuses for conduct that presents the risk of harm to investors, customers and the integrity of the markets.”

A focus on fair outcomes is also evidenced by recent enforcement action regarding the wholesale investor disclosure exclusion. This exclusion applies to investors who are highly experienced and/or well resourced. Once applied, the wholesale investor is, to put it bluntly, “on their own” as they do not receive the normal disclosures given to retail customers [2]. The FMA conducted an investigation into the application of the exclusion and issued formal warnings to a number of entities for improper reliance on the exclusion and failing to give appropriate disclosures to investors. The FMA is clearly interested in ensuring investors who should properly be classed as retail investors are adequately protected.

Commerce Commission

Following the announcement of the major trading banks’ financial results towards the end of 2022, the Prime Minister cautioned the trading banks to reflect on their social licence in light of the cost-of- living pressures facing New Zealanders. Days after the Prime Minister’s call for caution, the Government announced that the retail banking sector would be the first to implement the Consumer Data Right framework through what is colloquially known as Open Banking. This will allow customers to easily move their data from one bank to another, thereby increasing competition. While a market study into the retail banking industry is a potential option, it’s more likely that the Commerce Commission will wait to see what impact the Open Banking reforms have.

The Minister of Commerce and Consumer Affairs, the Hon David Clark, has already identified two other potential industries for the next market study – the insurance industry and electricity industry. We expect the next market study to be announced in the first quarter of 2023.

In 2022, the Commerce Commission launched investigations into the acquisition of land and the lodging of land and lease covenants by supermarkets, as well as a market study into the market for residential building supplies. The Commerce Commission’s actions likely reflect concerns over the cost-of-living crisis and inflationary pressures, as well as the expansion of the Commission’s powers to conduct market studies. We expect this focus on cost of living to continue into 2023.

Finally, proper remediation will likely be a focus of the Commission in 2023. In the latter part of 2022, the Commission released draft remediation guidance for consultation. The purpose of this guidance is to support businesses to “put the customer right” where they have identified a likely breach of one of the laws the Commission enforces. This provides businesses with a useful reference point for determining if, and how, they should provide remediation in relation to a likely breach of the law. While the guidance has been prepared by the Commission for breaches of legislation it enforces, the principles will be useful guidance for a range of other regulatory contexts.

Reserve Bank of New Zealand

2023 marks two years since the RBNZ’s Enforcement Department was established. To date, it has focused primarily on AML/CFT.

In early 2022, the RBNZ released its Enforcement Principles and Criteria which provide clarity on how and when the RBNZ will take enforcement action. These Principles and Criteria include a number of enforcement criteria and factors which, at their core, relate to the social licence of the entities the RBNZ regulates. In particular, one criterion which will be weighed by the RBNZ when making an enforcement decision is “public trust and confidence”. Misconduct which is widespread or significant in its magnitude, and which undermines public trust and confidence in a regulated entity, is also more likely to undermine the social licence of that entity.

Since the Enforcement Principles and Criteria were published, the RBNZ has published one enforcement action. This was a formal warning issued to a bank regarding failures to report the correct location of approximately 50,000 domestic cash transactions. Complementing the Enforcement Principles and Criteria, the RBNZ published its Enforcement Guidelines and Investigation Guidelines on 26 January 2023. The Enforcement Guidelines provide a regulatory response model for enforcement by the RBNZ and include further detail of how RBNZ will apply the Enforcement Principles and Criteria. The Investigation Guidelines describes the RBNZ’s approach to investigations and how to apply the Enforcement Principles and Criteria throughout the lifecycle of an investigation. The Investigation Guidelines also describe the use of information gathering powers under the legislation [4].

We can expect to see the RBNZ issuing formal notices for information requests more regularly than voluntary requests as the RBNZ has expressly recognised in its Investigation Guidelines that recipients of requests for information often feel more protected by a formal request or have obligations of confidence which mean they cannot disclose information without being compelled to do so. It is also important to note that information provided to the supervision arm of the RBNZ can be used by the enforcement team in an investigation and any later enforcement action so a linked up approach to dealings with the RBNZ is required.

As the RBNZ’s regulatory culture develops, of which the Enforcement Principles and Criteria, Investigation Guidelines and Enforcement Guidelines are important foundations, it is likely the amount of enforcement action undertaken by the RBNZ will increase significantly.

Footnotes

[1] Samantha Barrass, CEO Financial Markets Authority (speech at 2022 INFINZ Conference – Navigating the Transition, 27 October 2022).

[2] As above.

[3] Samantha Barrass, CEO Financial Markets Authority (speech at 2022 INFINZ Conference – Navigating the Transition, 27 October 2022 and the Financial Services Council, 16 March 2022).

[4] Reserve Bank completes new Enforcement Framework (31 January 2023) MinterEllisonRuddWatts.